This part will discuss about the history of GBTC, one of the most crucial instrument that brought down Three Arrows Capital (3AC) & BlockFi.

History

As mentioned by last part, GBTC is managed by Grayscale, a subsidiary of Digital Currency Group (DCG). It started the private placement on 25-Sep-2013 & did a series rounds of ‘fights’ with SEC to be legalised to trade in a public market with FINRA approval.

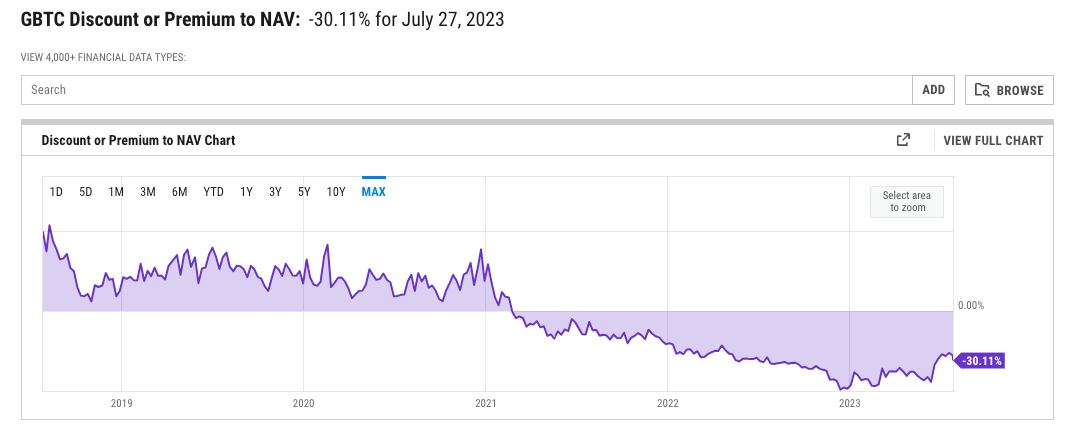

Spread to NAV

Since inception, GBTC is always trading at premium, but since early 2021, it had turned to a discount, and the timeline is inflexion point is of similar time when the price marked one of the bull market top & Coinbase listing. Three Arrows Capital (3AC) dominated an ‘arbitrage’ trade, which they publicly mentioned, that they kept do a BTC deposit to Grayscale for issuance of GBTC with a delta hedge & sell all of these at a premium after 6 months lock-up period & unwind the short position of BTC, in which when they were kept looping the same trade, it went from premium to discount & their position was underwater. Moreover, BlockFi also did the same trade. The real reasons behind could be this trade was over-crowded & more ETF competitions with a change of sentiment.

Back in the days in June 2022, there was a news that, when 3AC were closed to blow-up state, 3AC via TPS pitched investors to do an arbitrage, Three Arrows could lock up BTC with TPS for 12 months and receive a promissory note in return for the bitcoin as the last resort to raise money.

"Upon conversion (GBTC becomes and ETF and GBTC can be redeemed for BTC) clients receives 1.x BTC minus our 20% performance fee."

"In case of no conversion even within 12 months, the client will receive 1* (Y end - Y start)," the note reads. "Y = GBTC discount % at that time."

"Any widening of the discount would be absorbed by the investor's principal."

The spread kept widening as long as the rumor of DCG got into a huge financial trouble after FTX bankrupted & the spread basically represented the market sentiment from bull to bear market perfectly.

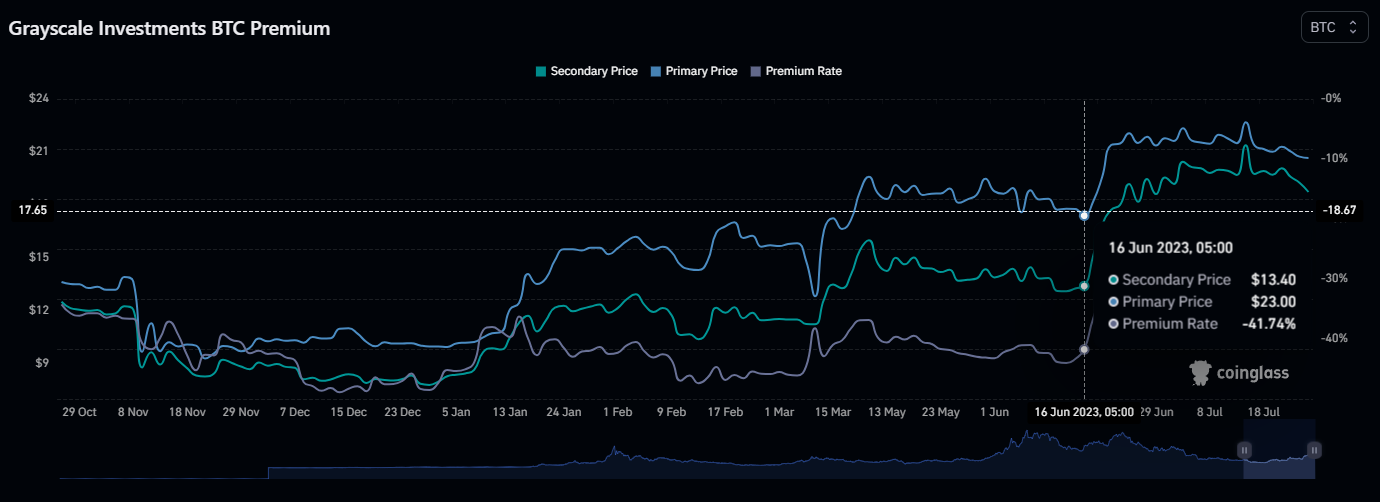

BlackRock ETF application

On 16-Jun-2023, BlackRock filed for bitcoin ETF, which then also incentivized other huge asset management companies also applied for it. Since then, people are optimistic that GBTC would also be converted to ETF if BlackRock does it successfully.

Endgame

There is an argument that Grayscale would try hard to avoid the conversion to ETF since they are charging a 2% of management fees, that is significantly larger than usual fees of ETF. The endgame of GBTC are of 3 cases:

GBTC converts to ETF (could be if BlackRock gets approval, no obvious reason why GBTC cannot convert)

GBTC cannot converted to ETF & Grayscale liquidated the trust (unlikely to happen unless they are forced to do it)

GBTC keeps in a discount to NAV & is unlikely to see a premium anymore

For long term investors can do a mental calculation of different scenarios & comes up with an expected value with the consideration of 2% annual fees, 10bps fees on transaction (via Interactive Brokers) to determine if it is a good tool to take Bitcoin exposure. For traders, the Blackrock ETF application might have updates that GBTC spread will then reflect the sentiment. A delta-neutral leg trade is a nice way to bet the spread goes up or down.